Are we on the road to a New World Order? Is it already here? What used to be a conspiracy theory seems obvious now. Imagine the signs being like road signs, clearly marked as the architects of the New World Order reach their destination. Since the turn of the 21st century there’s been a major event every seven years. If we follow the seven year pattern the next big event could be due this month. I hope I’m wrong. Meanwhile I want to set up signs and mark the road laid out so far.

Twenty one years ago in Sept 2001, 911

The first event was 911 in 2001 where George Bush Junior and Tony Blair very quickly after announced a “New World Order.”

Six weeks after 9/11, President Bush signed the USA Patriot Act, which lowered protections against government collection of Americans’ communications and personal records. The Pentagon developed a vast new surveillance and information analysis system and DARPA hosted and ran the spy program.

The world changed after the towers fell. We started losing our privacy and travel soon became a nightmare, all in the name of “keeping us safe.”

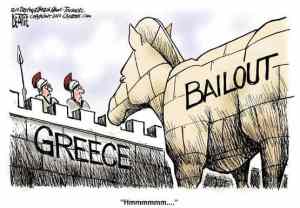

Fourteen years ago in Sept 2008, the GFC

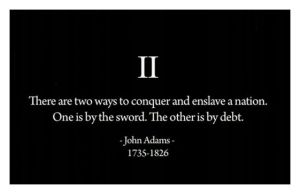

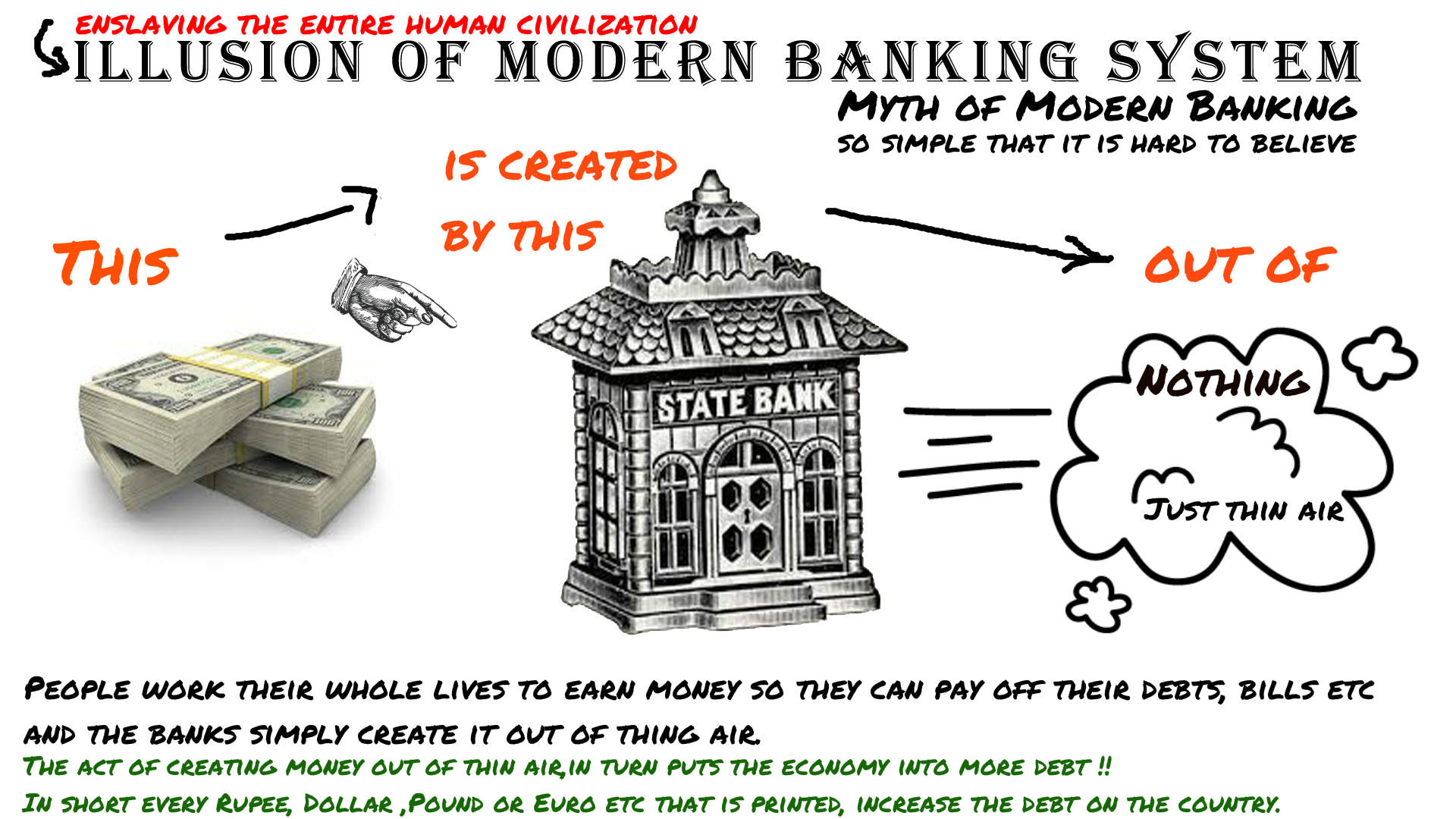

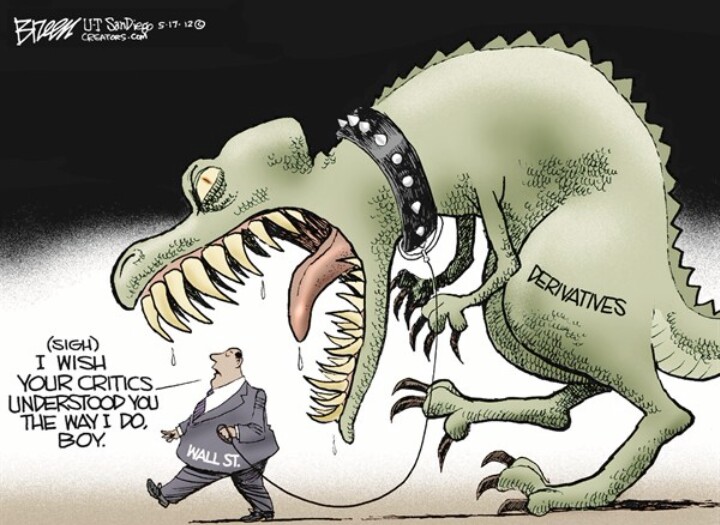

Then in 2008 there was the GFC, the Global Financial Crisis where the stock market plunged 777 points in the biggest fall in history. I don’t think this event was deliberate, given the sevens it was more like a warning from God. George Bush appeared on TV begging for a bailout. The banks were bailed out by the American Tax payer and nothing changed, the money went to the 1% and the bankers carried on embezzling, gambling and guzzling from the money spigot.

I thought after kicking the financial can down the road that it would all come to a screeching halt in 2015 but it didn’t. There were other items on the agenda.

Seven years ago in 2015, the Year of Lucifer

What happened in 2015? A lot of events – the big ones coinciding in September.

To begin with, 2015 was declared to be “The Year of Light” by the UN.

So what you say? Lucifer is known as “the Light Bringer.”

For Satan himself transforms himself into an angel of light. Therefore it is no great thing if his ministers also transform themselves into ministers of righteousness, whose end will be according to their works.

2 Corinthians 11:14-15

In Sydney, Australia the New Year opened with the theme of light as a big lightbulb appeared on the Sydney harbour bridge. Why would a sovereign nation not choose their own theme? Obviously it was orchestrated by the UN. That for me was the first sign of an unknown, unelected world government pulling the strings. Unfortunately the UN government now extends from New York right down to local council level.

Signs in the Heavens

There were signs in the heavens culminating with the fourth moon of the tetrad – a series of four blood moons which began at Easter / Passover of 2014 and ended in September 2015.

On the final blood moon, the United Nations celebrated its 70th anniversary amidst much fanfare as they launched Agenda 2030, the framework for World Government on September 27th 2015.

Pope Francis even flew in to New York for the occasion. He is the 266th pope to reign and he arrived on the 266th day of the year. And it takes around 266 days for a pregnancy! Jesus did say there’d be birth pangs.

I thought about all these events during my Bible reading and the words to the Creedance Clearwater song “Bad Moon Rising” kept coming to mind.”

The Novus Ordo Seclorum

Novus Ordo Seclorum means “The New Order of the Ages.” This is what the architects of the New World Order have been working towards. They’ve played a long game.

The pyramid is an important symbol in Freemasonry. They have the eye over the uncapped pyramid in the “accomplishment of the great work.” When will that be? The height of the unfinished Great pyramid of Giza is 146.7m (481.3ft). If you multiply 481.3 feet x 12 inches you get 5775.6 inches.

2015 = Anno Mundi Year 5775

1776 is on the base of the pyramid of the US dollar bill in the form of the Roman numerals MDCCLXXV1, for 1776 the Year of Independance. Under that date is “Novus Ordo Seclorum,” the New Order of the Ages.

The Ancient and Accepted Scottish Rite use the dating system of Anno Mundi, the Year of the World, where they add 3,760 to the common date. So the common calendar year 2015 would be A.M. 5775.

They also use the Hebrew month and new year, so they begin to add another year after September 17th, making it the year Anno Mundi 5776.

It’s interesting that this branch of Freemasonry is using the Jewish dating system. 2015 was an important year for both Freemasons and Jews as the Year of Lucifer COLLIDED with the Jewish Year of Jubilee. The Year of Jubilee happens after seven lots of seven sabbaths totalling 49 years. For the Jews, it was a Jubilee year on their calendar, which happened on the 50th year, in September.

And now, here’s how the year 2015 or 5775 / 5776 was celebrated:

The Highway to Hell

In the entertainment industry the year 2015 opened in February with the wealthy and powerful wearing devil horns at the Grammys, singing along to “Highway to Hell” by ACDC. It seems a great song to rock to, but consider this:

The gate to hell is wide and the road that leads to it is easy, and there are many who travel it.

Matthew 7:13

There was also an act by Madonna where she danced with horned devils.

The theme was “Darkness to Light.”

Woe to those who call evil good, and good evil;

Who put darkness for light, and light for darkness;

Who put bitter for sweet, and sweet for bitter!

The nations signed Agenda 2030 at the UN in September and the Paris Climate Treaty in December sealed the deal. The carbon tax for the Paris treaty on Climate Change was adopted by consensus on 12 December 2015. Solomon’s tax was 666 talents of gold. Note the atomic number of carbon: carbon has 6 protons, 6 neutrons and 6 electrons, making it the physical representation of 666.

Another Sign in the Heavens, an astroid

In the intervening period a huge asteroid the size of the football stadium had a close encounter with Earth on Oct. 31st 2015. Did you know about that? It was a dead comet in the shape of a skull.

An Offering on Friday the 13th?

In November 2015, not long before the signing of the Paris Climate Treaty, there was the Friday the 13th Paris attacks. The biggest loss of life was at the Bataclan Theatre where the band on stage, Eagles of Death Metal had started to play “Kiss The Devil.” I guess he showed up, 89 concert goers died while they were singing it. Were they sacrificed?

The Vatican celebrates Agenda 2030

The year concluded in December with the Fiat Lux light show at the Vatican on December 8th 2015. Lux is Latin for light.

“I am sorry that the facade of St. Peter’s has been turned into a propaganda stage for the scientific fraud known as ‘Catastrophic Man-Caused Global Warming,” Steven Mosher, president of the Population Research Institute, told LifeSiteNews;“I am sick at the thought that this most sacred space — St. Peter’s Basilica — will be the backdrop for the further dissemination of this fraud, whose ultimate goal is to impose a ‘Carbon Tax’ on the developed countries. This tax will not only cripple global economic growth and undermine democracy, its proceeds will be used to fund even more population control programs in the developing world,” he said.

‘Sacrilege’: Catholic leaders react to Vatican’s ‘climate change’ light show

Links

The UN’s 70th anniversary

Pope Francis visited the UN to endorse Agenda 2030.

Sustainable Development unanimously adopted by 193 members

Light

The International Year of Lucifer

UN/UNESCO International Year of Light 2015 Final Official Trailer

Freemasonry

What The Pyramid On The Back Of A One Dollar Bill Means

Grammys 2015

Katy Perry Wore Devil Horns As “Highway To Hell” Opened 2015 Grammys

Signs in the heavens

The Skull-Shaped ‘Halloween Asteroid’ is Coming Back in 2018

The tetrad : 27-28 Sep 2015 The astrological event, known as a blood moon occurred on September 27 in the U.S. and end a just after midnight on September 28. Although blood moon occurs a few times a year in various parts of the world, a tetrad is rare. A blood moon occurs when the earth casts its shadow on a full moon, causing a red glow.

This one is different for several reasons. It is the fourth blood moon in a tetrad and it will fall on the Jewish holiday of Sukkot. The first three instances of the tetrad already occurred on April 15, 2014, which was on Passover, October 8, 2014, on Sukkot, and April 4 of this year on Passover.

The last tetrad occurred in 1967 and 1968, when Israel recaptured Jerusalem.

At the same time, uncontrollable fires were raging in California.

Agenda 2030

Carbon

Carbon 666 – THE SECRET ~ Rex Reviews

The Carbon Tax

We will all be subject to a carbon allowance and tax – our “carbon footprint.” The carbon atom is made up of 6 protons, 6 electrons and 6 neutrons. In the name of Agenda 2030, populations will be told to lower their carbon footprint by having one less child, living car free, forgoing air travel, and going vegan.

Source: Wikipedia, Carbon Footprint

Contrast this to the lifestyle of the global elite who fly to Davos each year. The phrase “Davos Man” was credited to Samuel P. Huntington, a political scientist who spent the majority of his working life at Harvard University. In 2004, he wrote a paper about elites and “an emerging global superclass” of “Davos men” or “gold-collar workers …”

CNBC Who are the ‘Davos Man’ and the ‘Davos Woman?’

“The rewards of an increasingly integrated global economy have brought forth a new global elite. Labeled ‘Davos Men,’ ‘gold-collar workers’ or… ‘cosmocrats’, this emerging class is empowered by new notions of global connectedness. It includes academics, international civil servants and executives in global companies, as well as successful high-technology entrepreneurs,” Huntington wrote, citing an estimation that this elite would total 40 million people by 2010.

He said such global elites “have little need for national loyalty, view national boundaries as obstacles that thankfully are vanishing, and see national governments as residues from the past whose only useful function is to facilitate the elite’s global operations.”

What they enjoy, we will not be permitted to enjoy.

Sydney, Australia:

Agenda 21 has been in force in Australia and now they’ve adopted Agenda 2030. “Sustainable Sydney 2030″ is a set of goals we have set for our city to help make it as green, global and connected as possible by 2030. The plan will transform the way we live, work and play.”

Sustainable Sydney

Notes

Anno Lucis

Another dating system is Anno Lucis, the year of Light, where you add 4000 years to the current Gregorian year because the world was reated from light 4000 years ago. The year begins in September of the Hebrew calendar. It’s a dating system used in Masonic ceremonial or commemorative proceedings.

Anno Mundi

The Ancient and Accepted Scottish Rite also date their calendar beginning with the creation of the world, but they use the Jewish calendar, or Anno Mundi (In the Year of the World). The Scottish Rite adds 3,760 years to the common date, so the common calendar year 2016 would be A.M. 5776. They also use the Hebrew month and new year, so they begin to add another yearafter September 17th.

Source: Grand Lodge of Iowa: Why you should never ask a Freemason the date…

We’ve been sitting down playing the latest game of Monopoly these holidays. The board is an ominous black colour, there’s no cash and it’s ruthless! At least you get round the board quickly. Even my husband joined in. He normally refuses to play, calling the standard game “Monotony.”

We’ve been sitting down playing the latest game of Monopoly these holidays. The board is an ominous black colour, there’s no cash and it’s ruthless! At least you get round the board quickly. Even my husband joined in. He normally refuses to play, calling the standard game “Monotony.” In the New Zealand version of our rigged game of Monopoly, if I as the Banker did get into trouble, I would take your money to keep myself in the game. It’s called the

In the New Zealand version of our rigged game of Monopoly, if I as the Banker did get into trouble, I would take your money to keep myself in the game. It’s called the

New Zealand has got a previously unheard of problem – homeless families are sleeping in cars, while nearly half of the houses in our largest city Auckland (49%) are being snapped up by foreign investors and then sitting there empty! The Chinese were the biggest group. Last year in June it was 41% of Auckland homes.

New Zealand has got a previously unheard of problem – homeless families are sleeping in cars, while nearly half of the houses in our largest city Auckland (49%) are being snapped up by foreign investors and then sitting there empty! The Chinese were the biggest group. Last year in June it was 41% of Auckland homes.

(3) Foreign Bank lending causing housing inflation. The other reason for inflated housing prices is bank lending. NZ’s banking sector is dominated by big Australian Banks – called “the big four.” New Zealand banks were sold to them in the 1990’s. The big four are the ANZ, NAB, Westpac and Commonwealth Bank. These foreign-owned banks hold 90% of New Zealand’s mortgages.

(3) Foreign Bank lending causing housing inflation. The other reason for inflated housing prices is bank lending. NZ’s banking sector is dominated by big Australian Banks – called “the big four.” New Zealand banks were sold to them in the 1990’s. The big four are the ANZ, NAB, Westpac and Commonwealth Bank. These foreign-owned banks hold 90% of New Zealand’s mortgages.